Retirement is a phase of life that most of us look forward to. It’s a time when you can finally sit back, relax, and enjoy the fruits of your labor. However, to have a stress-free retirement, it’s important to plan ahead. In this step-by-step guide, we will walk you through the process of retirement planning, starting from the basics to managing risk and protecting your savings.

Understanding the Basics of Retirement Planning

Retirement planning involves setting goals and making financial decisions that will enable you to achieve those goals. The first step is to define your retirement goals.

Planning for retirement is a crucial aspect of financial stability and peace of mind in later years. It involves a plan that how to plan for retirement strategic approach to managing your finances and investments to ensure a comfortable and secure future. By carefully considering your retirement goals and taking proactive steps, you can pave the way for a fulfilling and worry-free retirement.

Defining Retirement Goals

Everyone’s retirement goals are unique. Some may want to travel the world, while others may aspire to spend quality time with family and pursue hobbies. Take some time to reflect on what you envision your retirement to be like. This will help you determine how much money you’ll need to save and how you’ll allocate your resources.

Visualizing your ideal retirement lifestyle can provide clarity on the financial milestones you need to reach. Whether it’s retiring in a serene countryside setting or exploring new cultures around the globe, understanding your aspirations can guide your savings and investment strategies.

Importance of Starting Early

When it comes to retirement planning, time is your greatest ally. The earlier you start saving, the more time your money has to grow. This is due to the power of compounding. Even small contributions made consistently over a long period can result in substantial savings.

Starting your retirement savings journey early not only allows for the potential growth of your investments but also provides a buffer for unexpected expenses or financial challenges that may arise along the way. By establishing a habit of regular saving and investment early on, you can build a strong financial foundation for your retirement years.

Assessing Your Current Financial Status

Before you can determine how much you need to save for retirement, it’s essential to evaluate your current financial status. This evaluation serves as the foundation for creating a solid financial plan that will support you in your retirement years.

Understanding where you stand financially involves a comprehensive assessment of your assets, liabilities, income, and expenses. By taking a closer look at these key components, you can gain valuable insights into your financial health and make informed decisions about your future.

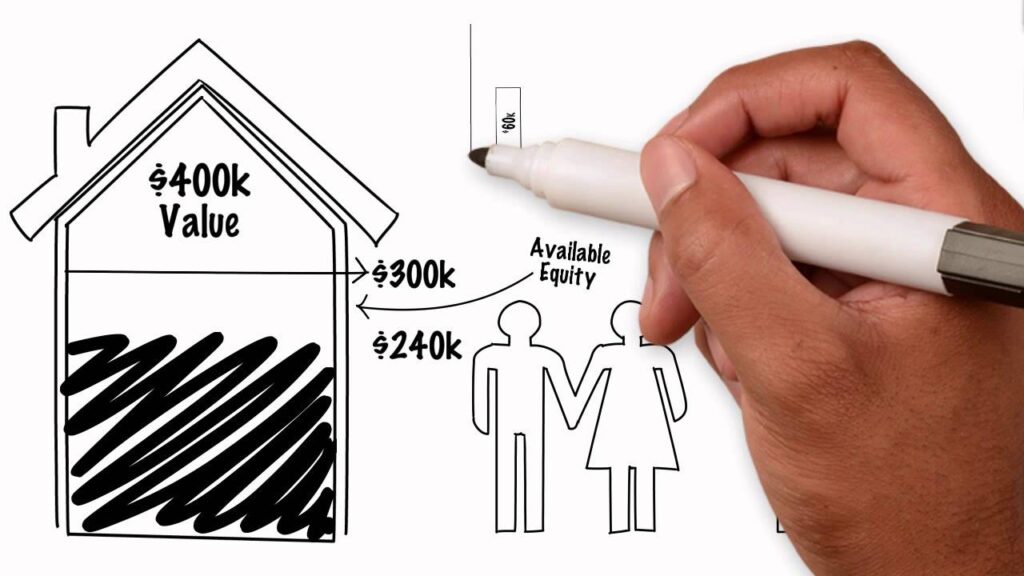

Evaluating Your Assets

Take stock of all your assets, including your home, vehicles, investments, and savings accounts. These assets will play a crucial role in funding your retirement. Assessing the value of your assets allows you to see the big picture of your financial worth and determine how best to leverage these resources for a comfortable retirement.

Additionally, consider the growth potential of your assets over time. Investments, in particular, have the potential to appreciate and generate additional income for your retirement years. By understanding the growth trajectory of your assets, you can make strategic decisions to optimize their value.

Identifying Your Liabilities

On the other side of the coin, you’ll need to identify your financial obligations. This may include mortgages, loans, credit card debt, and other liabilities. Understanding your liabilities will help you make informed decisions about how to allocate your resources. It’s crucial to prioritize paying off high-interest debts to free up more funds for saving and investing in your retirement fund.

Furthermore, evaluating your liabilities provides insight into your financial responsibilities and allows you to create a plan to reduce or eliminate debt over time. By managing your liabilities effectively, you can strengthen your financial position and work towards a more secure retirement future. Read more about eliminate at https://www.ega.edu/about/at-a-glance/policies-and-procedures-of-the-college/03-creation-and-elimination-of-academic-programs.html

Creating a Retirement Budget

A retirement budget will serve as your roadmap for managing expenses and ensuring a comfortable retired life. Planning for retirement involves careful consideration of various financial aspects to guarantee a secure and enjoyable future.

When crafting your retirement budget, it’s essential to delve into the specifics of your financial needs and aspirations. By meticulously outlining your expenses and income sources, you can gain a comprehensive understanding of your financial landscape.

Estimating Living Expenses

Start by estimating your living expenses during retirement. Consider factors such as housing, utilities, transportation, food, and entertainment. It’s important to be realistic and account for inflation. Your living expenses may vary depending on your desired lifestyle in retirement, whether you plan to travel extensively, pursue hobbies, or downsize to a smaller home.

Additionally, allocating funds for unexpected expenses or emergencies can provide a safety net and ensure financial stability throughout your retirement years.

Factoring in Healthcare Costs

Healthcare expenses tend to increase as we age. Make sure to include estimates for health insurance, medication, and potential long-term care costs in your retirement budget. Prioritizing your health and well-being by budgeting for medical expenses is crucial for maintaining a high quality of life during retirement.

Moreover, exploring options such as long-term care insurance or health savings accounts can offer added financial security and peace of mind as you plan for potential healthcare needs in the future.

Exploring Retirement Savings Options

Now that you have a clear picture of your goals and expenses, it’s time to explore retirement savings options. Planning for retirement is a crucial step in securing your financial future and ensuring a comfortable lifestyle during your golden years.

One important aspect to consider when planning for retirement is the concept of inflation. Inflation erodes the purchasing power of your money over time, meaning that the amount you save today may not be sufficient to cover your expenses in the future. It’s essential to factor in inflation when setting your retirement savings goals and choosing investment options.

Understanding 401(k) and IRA Accounts

These retirement accounts offer tax advantages and are an excellent way to save for retirement. Familiarize yourself with the contribution limits, eligibility criteria, and investment options associated with 401(k) and IRA accounts. Many employers offer 401(k) plans with matching contributions, which can significantly boost your retirement savings over time. IRAs, on the other hand, provide individuals with more control over their investment choices and may offer tax benefits depending on the type of account.

Considering Other Investment Opportunities

In addition to retirement accounts, there are other investment opportunities you can explore to grow your savings. These may include stocks, bonds, real estate, or starting a small business. However, it’s important to consider the risks associated with each option and diversify your investment portfolio. Diversification can help mitigate risk and maximize returns by spreading your investments across different asset classes. To find more about diversify click here.

When considering real estate as an investment option, factors such as location, market trends, and potential rental income should be carefully evaluated. Investing in stocks and bonds requires a good understanding of the market and a long-term investment strategy. Starting a small business can be a rewarding venture, but it also comes with its own set of challenges and uncertainties. It’s crucial to conduct thorough research and seek professional advice before venturing into any new investment opportunity.

Managing Risk and Protecting Your Retirement Savings

As you approach retirement, it’s crucial to protect your savings and manage risk effectively. Retirement planning is a multifaceted process that requires careful consideration and strategic decision-making to ensure financial security in your golden years.

Diversifying Your Investment Portfolio

Spreading your investments across different asset classes can help mitigate risk. By diversifying your portfolio, you are less exposed to the fluctuations of a single investment. Consider investing in a mix of stocks, bonds, real estate, and other assets to create a well-rounded portfolio that can weather market volatility.

Furthermore, within each asset class, diversification is key. For example, when investing in stocks, consider spreading your investments across various industries and geographic regions to reduce the impact of sector-specific risks.

Planning for Long-Term Care

Long-term care can be a significant expense during retirement. It’s important to plan for this possibility by exploring long-term care insurance or alternative options to cover potential costs. Research different long-term care insurance policies to find one that suits your needs and budget, taking into account factors such as coverage limits, premiums, and benefit periods.

Additionally, consider other strategies to prepare for long-term care needs, such as setting aside a dedicated emergency fund or exploring government assistance programs that may help offset the costs of care.

Retirement planning is not a one-time event but an ongoing process. Regularly review and adjust your plan as circumstances change. Remember, the key to a successful retirement is starting early, setting clear goals, and making informed financial decisions. Use this step-by-step guide to embark on your retirement planning journey today!

Read about early retirment planning: Early Retirement Planning Tips for a Comfortable Future