Building financial resilience is a crucial aspect of achieving long-term financial stability. It involves developing the ability to withstand financial shocks and adapt to changing circumstances. One powerful strategy that can help individuals and families build financial resilience is debt recycling.

The Concept of Debt Recycling

What is debt recycling, is a financial strategy that involves leveraging existing debt to increase wealth accumulation. It is based on the principle of utilizing debt as a tool to generate investment income and maximize tax benefits.

Debt recycling is a concept that has gained popularity among individuals who are looking to optimize their financial position and make the most of their existing debt. By strategically redirecting non-tax-deductible debt towards tax-deductible investments, individuals can potentially save on taxes and generate additional income. Visit https://business-casualforwomen.com/maximizing-your-wealth-the-art-and-science-of-tax-planning for the the art and science of tax planning.

Defining Debt Recycling

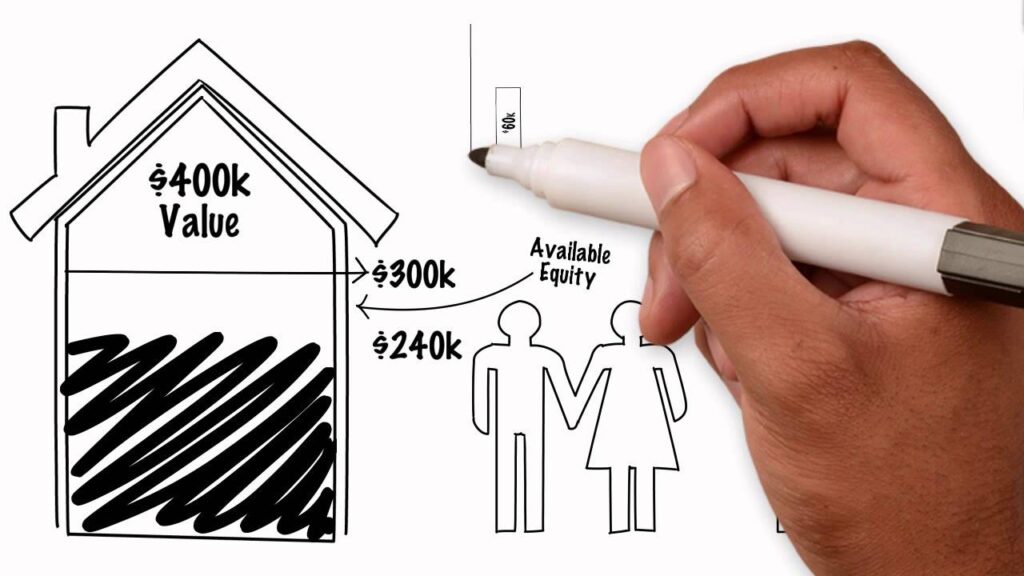

Debt recycling involves redirecting non-tax-deductible debt, such as mortgage or personal loan debt, toward tax-deductible investments, such as shares or investment properties. By doing so, individuals can convert their non-tax-deductible debt into tax-deductible debt, which can result in potential tax savings.

For example, let’s say you have a mortgage on your primary residence that is not tax-deductible. By implementing debt recycling, you could use the equity in your home to acquire an investment property. The interest on the loan for the investment property would be tax-deductible, potentially reducing your overall tax liability.

It is important to note that debt recycling should be approached with caution and careful consideration. It is not suitable for everyone and requires a thorough understanding of your financial situation, investment goals, and risk tolerance.

The Mechanics of Debt Recycling

The process of debt recycling typically involves the following steps:

- Evaluate Existing Debt: Review and assess your current debt situation, including interest rates, loan terms, and tax deductibility. This step is crucial in determining whether debt recycling is a viable strategy for you.

- Identify Investment Opportunities: Once you have evaluated your existing debt, the next step is to identify suitable investment vehicles that align with your financial goals and risk appetite. This could include shares, investment properties, or other assets that have the potential to generate income and appreciate in value.

- Implement Debt Repayment and Investment Strategy: With a clear understanding of your existing debt and investment opportunities, it is time to develop a plan to repay non-tax-deductible debt while simultaneously acquiring tax-deductible investments. This may involve refinancing existing loans, using equity in your assets, or taking on new debt strategically.

- Monitor and Adjust: Debt recycling is not a one-time event but an ongoing process. It is important to continuously monitor your debt and investment portfolio, making adjustments as needed to optimize your financial position. This could involve refinancing loans to take advantage of lower interest rates, rebalancing your investment portfolio, or reassessing your overall financial strategy.

By following these steps and staying proactive in managing your debt and investments, debt recycling can potentially help you build wealth and achieve your financial goals.

Understanding Financial Resilience

Financial resilience refers to the capacity to recover quickly from financial setbacks and maintain a stable financial position. It involves a combination of financial knowledge, planning, and proactive strategies to mitigate risks and navigate challenges.

Financial resilience is not just about being able to bounce back from financial setbacks, but also about being prepared for unexpected events and having the ability to adapt to changing circumstances. It is about having a solid foundation that can withstand the storms of life and provide a sense of security and peace of mind.

The Importance of Financial Resilience

Financial resilience is vital because life is full of uncertainties. Unexpected events, such as job loss, medical emergencies, or economic downturns, can significantly impact our financial well-being. By building financial resilience, individuals can minimize the negative effects of such events and quickly bounce back to a stable position.

Financial resilience is not just about surviving in times of crisis, but also about thriving in the face of adversity. It is about having the confidence and the resources to pursue opportunities and take calculated risks. It is about being able to weather the storms and come out stronger on the other side.

Key Components of Financial Resilience

Financial resilience encompasses various components, each playing a crucial role in building a solid financial foundation. These components include:

- Emergency Fund: Having a readily accessible fund to cover unexpected expenses can provide a safety net during challenging times. An emergency fund should ideally cover at least three to six months’ worth of living expenses, allowing individuals to navigate through temporary financial setbacks without resorting to high-interest debt or depleting their savings.

- Diversified Income Streams: Relying on a single income source can make individuals vulnerable. Diversifying sources of income can help mitigate risks and provide stability. This can include having a side hustle, investing in rental properties, or generating passive income through investments in stocks, bonds, or real estate.

- Insurance Coverage: Adequate insurance coverage, such as health insurance, life insurance, and property insurance, can protect individuals and their families from significant financial losses. Insurance acts as a safety net, providing financial support in the event of unexpected medical expenses, disability, or property damage.

- Debt Management: Responsible debt management is crucial for financial resilience. Debt recycling, in particular, can be an effective strategy to optimize debt and build wealth. It involves using the equity in one’s home to pay off non-deductible debts, such as credit card debt or personal loans, and then using the freed-up cash flow to invest in income-producing assets.

- Long-Term Savings and Investments: Building a robust savings and investment portfolio can help individuals achieve their financial goals and secure their future. This can include contributing to retirement accounts, such as 401(k)s or IRAs, investing in stocks and bonds, or exploring other investment opportunities that align with one’s risk tolerance and financial objectives.

Financial resilience is not built overnight. It requires discipline, patience, and a long-term perspective. It involves making informed financial decisions, setting realistic goals, and continuously adapting to changing circumstances. By prioritizing financial resilience, individuals can create a solid foundation that will not only help them weather the storms of life but also enable them to thrive and achieve their dreams.

The Role of Debt Recycling in Building Financial Resilience

Debt recycling plays a vital role in building financial resilience by offering several benefits and opportunities.

Financial resilience is crucial in today’s uncertain economic landscape. It refers to an individual’s ability to withstand financial shocks and maintain stability in the face of unexpected events. Debt recycling, as a financial strategy, can significantly contribute to enhancing financial resilience.

Debt Recycling as a Financial Strategy

By strategically utilizing debt recycling, individuals can enjoy potential tax savings, increase investment income, and build wealth over the long term. This strategy provides a structured approach to debt management and investment, allowing individuals to leverage their assets and optimize their financial position.

Let’s delve deeper into the benefits of debt recycling:

- Tax Savings: Debt recycling allows individuals to convert non-tax-deductible debt, such as personal loans or credit card debt, into tax-deductible debt, such as investment loans. This shift in debt structure can result in significant tax savings, as the interest paid on investment loans becomes tax-deductible.

- Increased Investment Income: By redirecting non-tax-deductible debt repayments towards tax-deductible investment loans, individuals can free up cash flow to invest in income-generating assets. This can lead to increased investment income over time, further strengthening financial resilience.

- Long-Term Wealth Building: Debt recycling enables individuals to use their existing assets, such as property or shares, as collateral for investment loans. By leveraging these assets, individuals can potentially amplify their investment returns and accelerate wealth creation in the long run.

The Impact of Debt Recycling on Financial Health

When implemented effectively, debt recycling can enhance an individual’s overall financial health by reducing non-tax-deductible debt, increasing the value of tax-deductible investments, and improving cash flow. It can also help individuals create a more diversified and resilient investment portfolio.

Here are some key ways in which debt recycling can positively impact financial health:

- Debt Reduction: Debt recycling allows individuals to pay off non-tax-deductible debt faster by redirecting cash flow towards tax-deductible investments. This can lead to a significant reduction in overall debt burden and improved financial stability.

- Increased Investment Value: By focusing on tax-deductible investments, individuals can potentially increase the value of their investment portfolio. As the interest paid on investment loans becomes tax-deductible, individuals can allocate more funds towards investment growth, ultimately boosting their financial resilience.

- Improved Cash Flow: Debt recycling can improve cash flow by restructuring debt and optimizing interest payments. By converting non-tax-deductible debt into tax-deductible debt, individuals can potentially free up additional funds for investment or emergency savings, providing a safety net during challenging times.

- Diversification and Resilience: Debt recycling allows individuals to diversify their investment portfolio by leveraging different asset classes. This diversification can help mitigate risks and enhance resilience against market fluctuations, ensuring a more stable financial future.

It is important to note that debt recycling should be approached with careful consideration and professional advice. Each individual’s financial situation is unique, and a tailored approach is necessary to maximize the benefits of this strategy.

Risks and Rewards of Debt Recycling

While debt recycling offers significant potential benefits, it is essential to be aware of its associated risks and rewards.

Potential Risks in Debt Recycling

Debt recycling involves risks, including changes in interest rates, fluctuations in investment returns, and market uncertainties. It requires a thorough understanding of personal financial circumstances, investment knowledge, and risk tolerance.

The Rewards of Effective Debt Recycling

When implemented wisely, debt recycling can yield rewards, such as tax savings, increased investment income, accelerated debt repayment, and long-term wealth creation. It can provide individuals with greater financial flexibility and the ability to capitalize on investment opportunities.

Strategies for Successful Debt Recycling

To ensure successful debt recycling, individuals should follow specific strategies and best practices.

Planning for Debt Recycling

Prioritize planning by carefully assessing your financial goals, risk tolerance, and debt-to-income ratio. Develop a comprehensive debt recycling strategy that aligns with your objectives and continually evaluate and adjust your plan as necessary.

Best Practices in Debt Recycling

Adopting best practices will maximize the effectiveness of debt recycling. These include maintaining a disciplined approach to debt reduction, regularly reviewing investment performance, seeking professional advice when needed, and staying informed about changing market conditions and tax regulations.

Conclusion

Building financial resilience is critical for navigating life’s financial challenges. Debt recycling can be a powerful tool in creating a more resilient financial position. By understanding the concept, benefits, risks, and strategies involved, individuals and families can harness the power of debt recycling to build long-term financial resilience and achieve their financial goals.